Our Automotive Observations during the COVID-19 situation

With uncertainty all around us, the time has never been better to do a market analysis. In this blog we will cover the Automotive industry which has several fundamental new insights to explore. Some of them have emerged months ago, while others just recently started to trend.

Topics covered in this blog

- 9 dominant topics within automotive industry;

- Covid-19 topic started to trend at the beginning of April;

- Car brands are collaborating with Healthcare industry;

- Citroën is experiencing lots of negative publicity;

- Car brands are advertising less on Social media.

Topics discussed

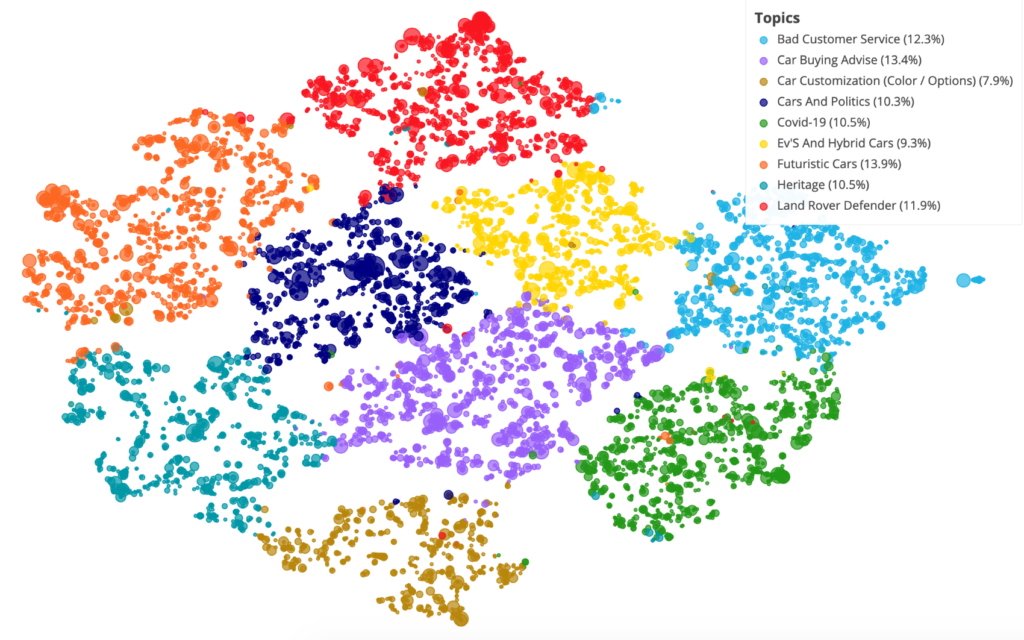

Firstly, we did extensive research on the thousands of comments that car brands received during the crisis period. Our tooling allowed us to identify what the audience feels and says about car brands which helped to identify 9 different topics.

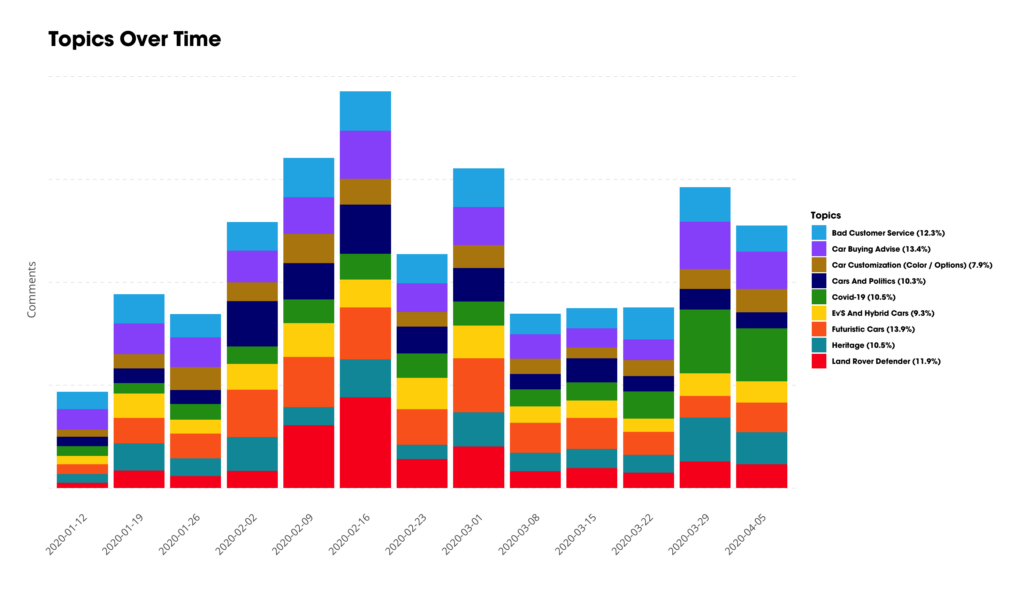

In the visualization above we mapped +10.000 comments by topic which gives an overview of the major themes that the car enthusiast audience was discussing the past few months. The themes “Futuristic cars, 14%”, “Car Buying Advice, 13%” and “Bad Customer Service, 12%” were among the most popular topics. However, since the beginning of April, the topic “Covid-19, 11%”, has shown a significant growth – this can be seen in the graph below.

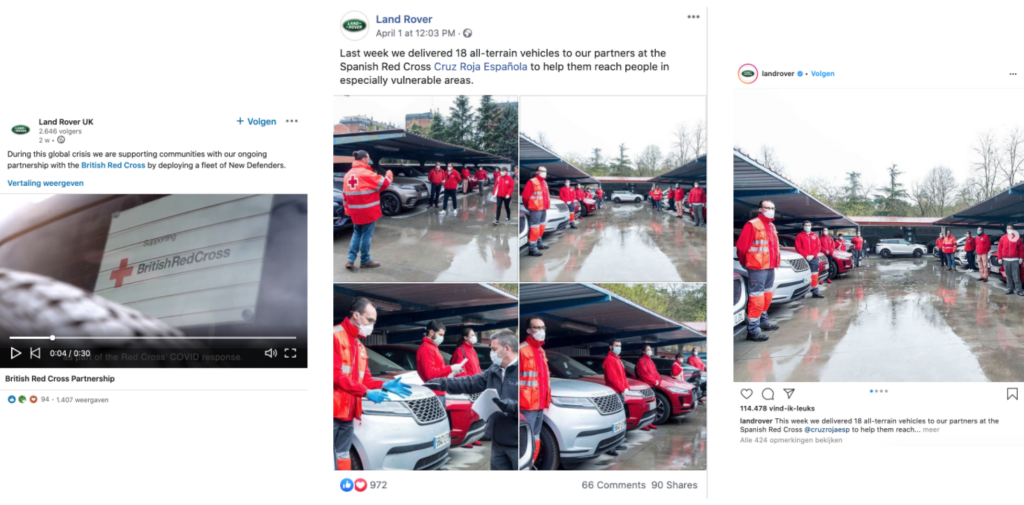

The significant increase in comments around the Covid-19 topic, was highly related with the expanding problems all across the globe. As such, a lot of car brands started to help out the healthcare industry, resulting in a lot of reactions. One example is Land Rover, who did a big collaboration with the Red Cross.

Peugeot also helped the national health service by offering them free roadside assistance.

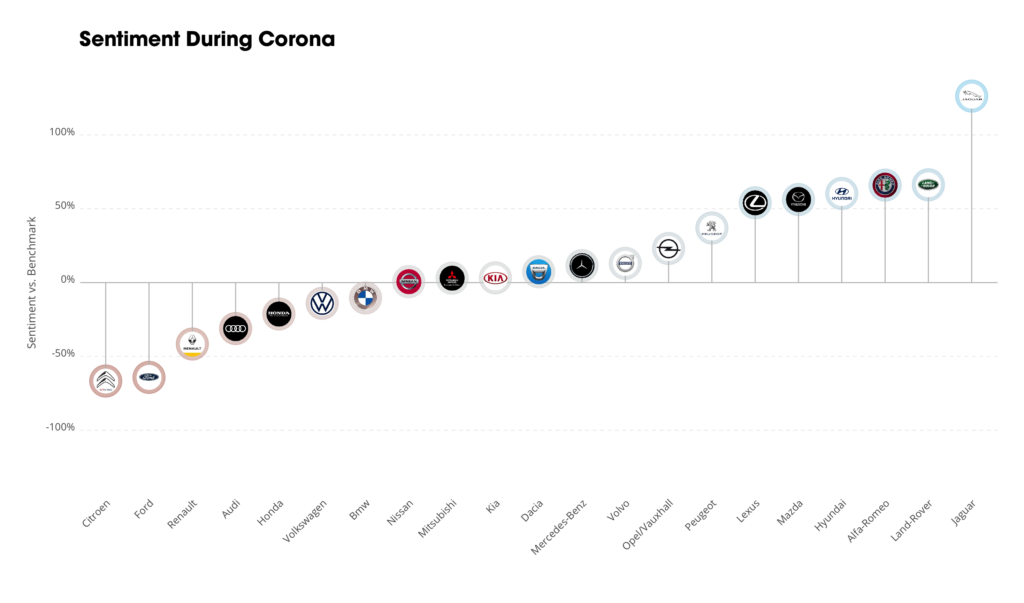

And like these two brands, there have been a lot of other initiatives going on already, resulting in a significant increases of positive reactions for the brands in concern. Below you can see an overview of all the Car brands and the sentiment per brand during the Covid-19 crisis so far.

As you can see, there are both big positive and negative outliers in terms of sentiment. As for the negative outliers, Citroën got hit hard especially. This had mainly to do with the following post.

At first glance, there doesn’t seem to be a lot wrong with this post. However, looking at the comments of this post, one can see that there are a lot of complaints about the Citroën factories that were still opened at the moment of posting. Which made the copy “Moments to be home, #Stay Home #! Stay Home” quite controverse in the eyes of the audience. On the 16th of March, Citroën also closed its factories resulting in a positive uptick in sentiment.

Car factories are closed

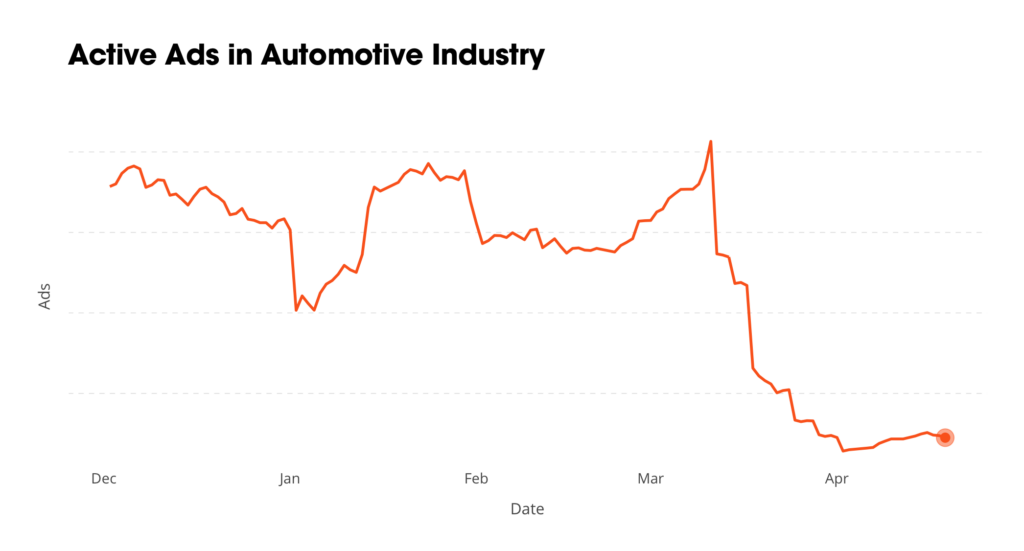

The closing of the car factories is currently influencing the entire industry. Therefore, most car brands paused all their advertisements around mid-March, which is a trend we also saw in the air travel industry. Supply chain issues are growing and as a result marketing budgets seem to be frozen for the time being. This week we did see some brands that started to reactivate some of their activities again. We will keep a close watch on how this development proceeds.

The Takeaway

By closely monitoring the discussions around the automotive industry, we are able to track the sentiment and anticipate on trending topics for which car brands should be planning. In addition our ad intelligence service show you exactly what your competitors are focusing on, giving you a competitive edge.

If you want to learn more about our automotive case or if you want to play with the interactive versions of the graphs , you can always reach out to us for a quick demo.

Related posts

How Airlines react on Social Media during the COVID-19 crisis